Donald Trump has secured his comeback as the 47th President of the United States, defeating Kamala Harris in a hard-fought 2024 election. This victory marks a historic return to the White House after a four-year hiatus, making Trump only the second U.S. president to regain office after losing a prior election. During his campaign, Trump doubled down on his signature “America First” economic policies, signaling a return to aggressive tariff measures aimed at protecting U.S. industries. As he prepares to take office in 2025, many are wondering what impact these policies will have on the economy, especially in a time of economic uncertainty and high inflation.

A Recap of Trump’s Previous Tariff Policies

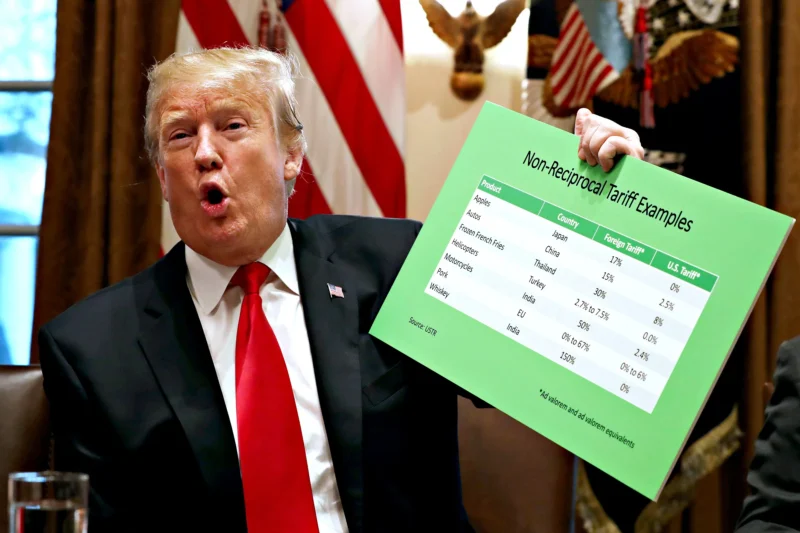

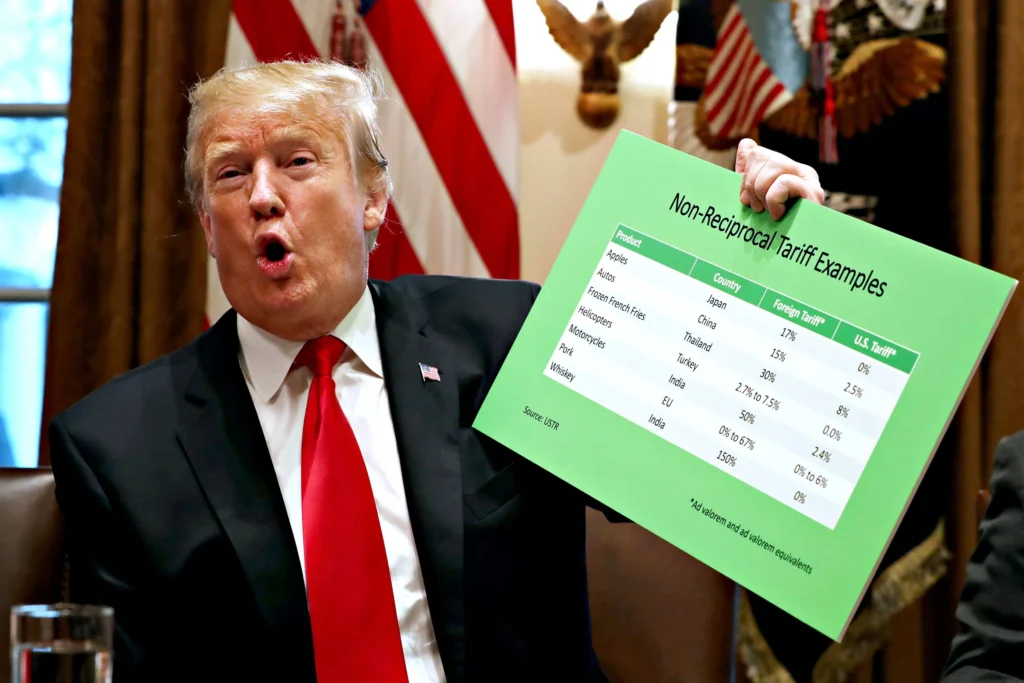

During Trump’s first term (2017-2021), his administration introduced a series of tariffs targeting foreign imports, with a particular focus on China. These tariffs were part of a broader strategy to reduce the trade deficit, protect American jobs, and pressure other countries into more favorable trade agreements.

Key tariffs from Trump’s first term included:

- Steel and Aluminum Tariffs: In 2018, Trump imposed a 25% tariff on steel and a 10% tariff on aluminum, impacting imports from key trading partners like Canada, Mexico, and the EU. This move was justified on the grounds of national security, but it also strained relations with traditional allies.

- China-Specific Tariffs: A major trade war with China unfolded, resulting in tariffs on over $360 billion worth of Chinese goods. The tariffs ranged from 10% to 25% on products like electronics, machinery, and consumer goods. This was part of Trump’s effort to address what he deemed unfair trade practices and intellectual property theft by China.

Economic Impact of the Tariffs (2018-2021)

The tariffs introduced during Trump’s first presidency had a mixed impact on the U.S. economy:

- Higher Consumer Prices

- Rising Costs for Goods: Tariffs on Chinese imports led to higher prices for everyday products, from electronics to household items. American consumers felt the pinch, especially during the holiday shopping seasons, as higher import costs were passed down to retail prices.

- Inflation Concerns: According to studies by the Federal Reserve and other economic analysts, the tariffs contributed to a modest increase in inflation, adding to the financial strain on American households.

- Impact on American Businesses

- Manufacturing: While the tariffs were intended to boost domestic manufacturing, many American companies faced increased production costs due to the higher price of imported materials. This was particularly challenging for industries that rely on global supply chains, such as the automotive and technology sectors.

- Agriculture: U.S. farmers were hit hard by retaliatory tariffs from countries like China, which targeted American exports such as soybeans, pork, and corn. To mitigate the losses, the U.S. government provided billions in subsidies to farmers, but these measures only partially offset the economic damage.

- Mixed Effects on Employment

- Job Creation vs. Job Losses: The tariffs did help create jobs in some sectors, like steel manufacturing, but these gains were offset by job losses in industries that depend on imported components. The higher costs of materials led to layoffs and reduced hiring in certain sectors, especially among small and medium-sized enterprises.

Trump’s Tariffs: What They Really Mean for America’s Future

Remember when buying washing machines didn’t cost an arm and a leg? That was before Trump shook up global trade with his tariffs back in 2018. Now, as he heads back to the White House in 2024, he’s promising to double down on his trademark “America First” trade policy – and it’s got everyone from Wall Street to Main Street talking.

What’s Coming in 2024?

Now Trump’s talking about taking it to the next level. He’s not just eyeing China anymore – he’s looking at hitting everyone with tariffs. We’re talking about:

- Cranking up those China tariffs even higher

- Going after European luxury goods (goodbye affordable French wines)

- Maybe even taxing Mexican imports to pressure them on immigration

Here’s what this could mean for your wallet: Everything from your new iPhone to that European car you’ve been eyeing might cost more. But Trump’s betting big that this pressure will bring manufacturing jobs back to American soil.

The Real Impact on Regular Americans

Let’s break this down to what matters for everyday folks:

Your Shopping Cart

Remember when that washing machine cost $500? Post-tariffs, many jumped to $700 or more. That’s the kind of price hike we might see on more products if these new tariffs kick in.

Your Job

This is where it gets interesting. Some industries are cheering – U.S. steel workers, for instance, saw some good times when foreign steel got more expensive. But then you’ve got companies that use steel scratching their heads about rising costs.

Your Community

Small businesses in your town might feel this one hard. Think about your local bike shop – they’re already struggling with higher costs for parts from overseas. More tariffs could mean tough choices about prices or even staying open.

What Business Owners Are Saying

I talked to Jim, who owns a manufacturing plant in Ohio. He tells me, “Sure, I like the idea of bringing jobs back to America. But right now, I can’t find anyone who makes the parts I need here in the States. These tariffs? They’re just making it harder to keep my prices competitive.”

The Bigger Picture

Here’s what a lot of economists are worried about: While tariffs might help some American industries in the short term, they could spark a global trade war. Think of it like a game of economic chicken – nobody wins if everyone keeps raising taxes on each other’s goods.

What This Means for America’s Future

The big question isn’t just about prices or jobs – it’s about America’s place in the global economy. Trump’s betting that playing hardball will give the U.S. better deals. But with countries like China growing more powerful every year, and allies like Europe getting tired of trade fights, we’re in uncharted territory.

What Can You Do?

If you’re worried about how this might affect you, here are some smart moves to consider:

- Keep an eye on prices for big purchases you’re planning

- Watch how your investments might be affected by trade tensions

- Stay informed about which industries might be hit next

- Think about whether your job could be affected by trade changes

The Bottom Line

Love him or hate him, Trump’s tariff strategy is reshaping how America does business with the world. Whether this ends up being a masterstroke that brings jobs back to America or a costly mistake that drives up prices – well, that’s what we’re all about to find out.

The only sure thing? The global economy is changing, and these tariffs are accelerating that change. Whether that’s good or bad for America might depend on where you’re sitting – but it’s definitely going to be interesting to watch.

Want to stay in the loop about how these changes might affect your wallet? check our blog we break down the complicated stuff so you don’t have to.